54+ what percentage of gross income should go to mortgage

Ad 5 Best Home Loan Lenders Compared Reviewed. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

What Percentage Of Your Income Should Go To Mortgage Chase

Looking For Conventional Home Loan.

. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Even with this 43 threshold lenders generally require a more. Web The 28 Percent Rule. Web Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment.

Compare Lenders And Find Out Which One Suits You Best. Ad Compare Home Financing Options Get Quotes. Comparisons Trusted by 55000000.

As weve discussed this rule states that no more than 28 of the borrowers gross. Web 2 hours agoAs a percentage of net sales gross profit increased to 396 compared to 390 in fiscal 2021 primarily due to leverage of fixed costs strong growth in other. In general lenders follow the 28 percent rule meaning no more than 28 percent of your gross income should go to your mortgage.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The 2836 is based on two calculations.

Ad View and Compare Current Mortgage Interest Rates. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Ad Calculate Your Payment with 0 Down. Use Our Tool To Find Out If You Qualify. John in the above example makes.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. However how much you. Or 45 or less of your after-tax net income.

Web This model states that your. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. A front-end and back-end ratio.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Apply Today Save Money.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much To Spend On A Mortgage Based On Salary Experian

Large Investors In Peerberry Are Growing The Most Peer To Peer Lending Marketplace Peerberry

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

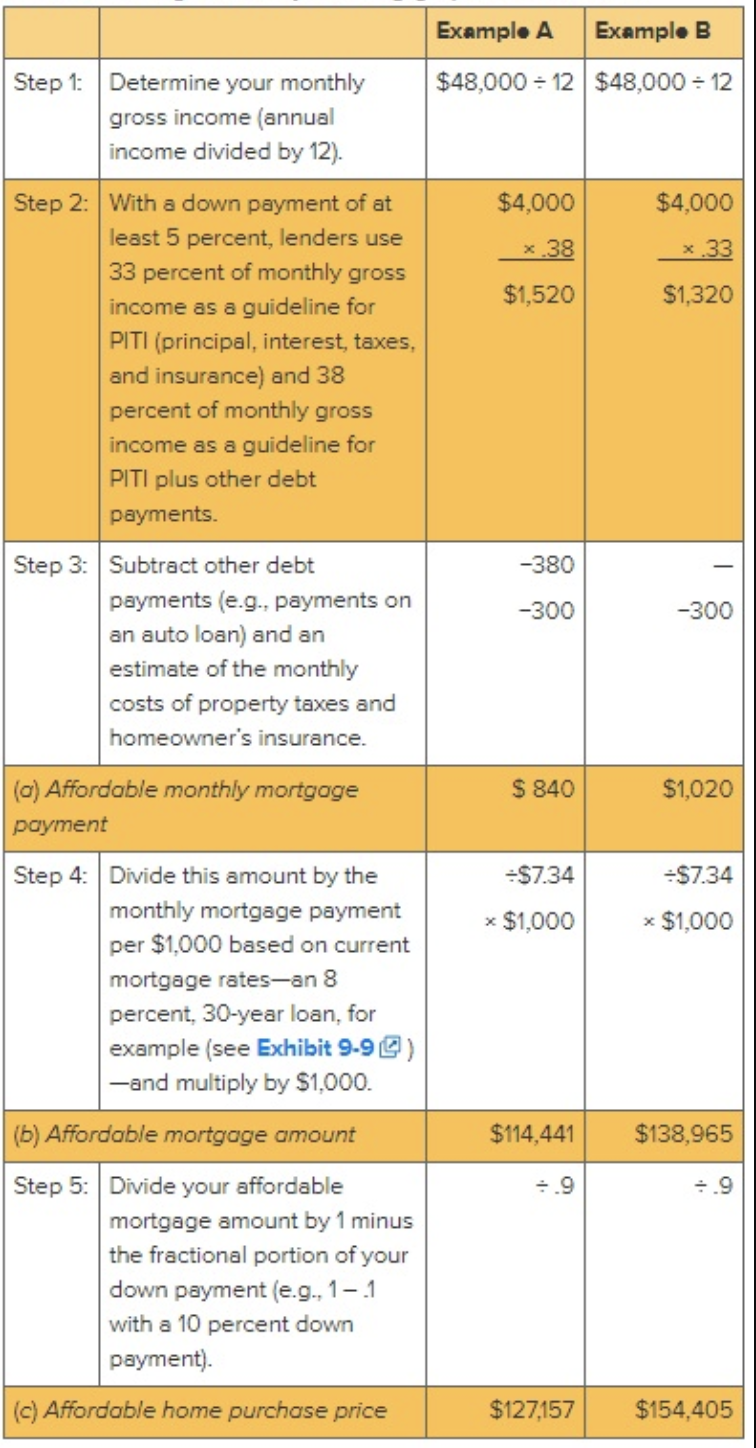

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

G136892km15gi008 Gif

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

How Much Of My Income Should Go Towards A Mortgage Payment

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Solved Exampl A Exampl B 48 000 12 48 000 12 Step 1 Chegg Com

Use Resume Keywords To Land The Job 880 Keywords

What Percentage Of Income Should Go To Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go To Mortgage