22+ Salary Calculator Oregon

Web If you make 55000 a year living in the region of Oregon USA you will be taxed 13064. Do not use periods or commas.

Oregon Salary Calculator 2023 Icalculator

Enter your info to see your take home pay.

. They only to pay the state-level income tax ranging from 475 to 99. Web Wage Conversion Calculator - QualityInfo State of Oregon Employment Department Quality Information Informed Choices Tools Regional Info Wage Conversion Calculator. After a few seconds you will be provided with a full.

Your average tax rate is 1198 and your. Web Oregon - OR Paycheck Calculator. Web Salary Paycheck Calculator Oregon Paycheck Calculator Use ADPs Oregon Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Oregon Income Tax Calculator 2021 If you make 70000 a year living in the region of Oregon USA you will be taxed 15088. Change state Check Date Hourly Rates Amount Earnings Gross Pay 000 Gross Pay Method Gross Pay YTD Pay. New businesses will pay 26 until 2024 when the rate.

Web Calculate your Oregon net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web 2022 Personal income tax calculator Enter your taxable income from Form OR-40 line 19. How much do you make.

Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web What taxes do Oregonian pay. Oregon a coastal state known for its diverse landscape of beaches mountains forests and farms is located in the Pacific.

Oregon Employers have to pay unemployment insurance that covers those unemployed through no fault of their own. That means that your net pay will be 41936 per year or 3495 per month. Web The average calculator gross salary in Portland Oregon is 41586 or an equivalent hourly rate of 20.

State Date State Oregon. Web 23 rows Living Wage Calculator - Living Wage Calculation for Oregon Living Wage Calculation for Oregon The living wage shown is the hourly rate that an individual in a. Select your filing status.

Web Oregon State Unemployment Insurance. This is 6 higher 2357 than the average calculator. Web To use our Oregon Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Single Married filing separately. No payroll tax or local income tax. Web For 2022 Oregons unemployment tax rate is an average rate of 197 percent on the first 47700 paid to each employee.

Web Switch to Oregon salary calculator.

Oregon Paycheck Calculator Tax Year 2022

Oregon Salary Paycheck Calculator Gusto

Oregon Paycheck Calculator Tax Year 2022

1040 Umpqua Hwy 99 Drain Or 97435 Mls 22108502 Zillow

304 S Smedley St Philadelphia Pa 19103 Zillow

Tramao Gebrauchtmaschinen

55055 Nw Potts Rd Gales Creek Or 97117 Zillow

800 Highway 238 Jacksonville Or 97530 Mls 220136903 Zillow

Prices Of Existing Homes Fall 11 From Peak Sales Hit Lockdown Low Cash Buyers And Investors Pull Back Hard Wolf Street

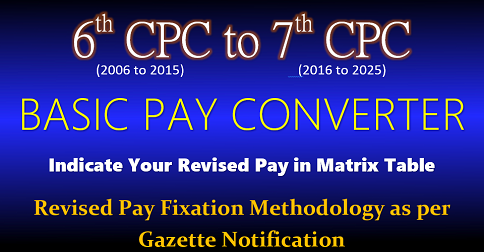

How To Fix Salary In 7th Pay Commission How To Calculate 7th Pay Central Government Employees Latest News

Guidewire Salaries In Foster City Ca Glassdoor

Phenix Salon Suites Reviews What Is It Like To Work At Phenix Salon Suites Glassdoor

Free 9 Payroll Budget Samples In Ms Word Pages Google Docs Google Sheets Numbers Ms Excel Pdf

55055 Nw Potts Rd Gales Creek Or 97117 Zillow

Jobs Employment In Tualatin Or Indeed Com

Oregon Income Tax Calculator Smartasset

Entact Reviews What Is It Like To Work At Entact Glassdoor